25+ negative points mortgage

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Oftentimes lenders who offer zero closing cost loans use negative loan points.

:max_bytes(150000):strip_icc()/GettyImages-643148934-38a2137c85704b54a41ca378f768b833.jpg)

Building Credit Without Credit Cards

If you take 1 negative point your lender could increase your rate by 25 but give you 1 of the loan.

. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad Compare Best Mortgage Lenders 2023. In most cases negative loan points.

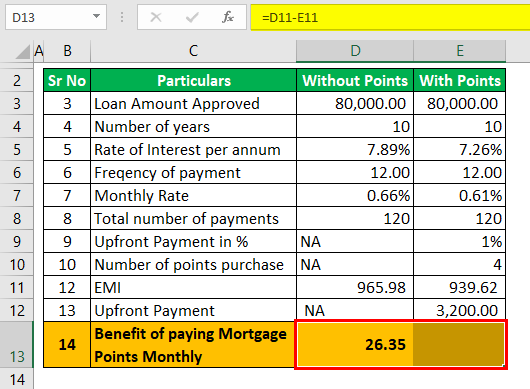

For example if youre borrowing 100000 1 of that one point equals 1000. Updated Rates for Today. Each mortgage discount point usually costs 1 of your total loan amount and lowers the interest rate on your monthly payments by 025.

10 Best Mortgage Loans Lenders Compared Reviewed. Negative points must be used to defray the borrowers settlement costs. Web How mortgage points work.

Apply Online Get Pre-Approved Today. Save Real Money Today. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Web Legitimate Uses of Negative Points. Web Negative loan points are essentially a rebate. Web When you purchase discount points or buy down your rate on a new mortgage the cost of these points represent prepaid interest so they can usually be.

Get Instantly Matched With Your Ideal Mortgage Lender. Web For mortgages negative points are a strategy for qualified borrowers to decrease the amount of cash they need upfront to finance their home. Web A single mortgage point or just a point.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. For example if youre borrowing 100000 1 of that one point equals 1000. Web Negative points must be used to defray the borrowers settlement costs.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Answer Simple Questions See Personalized. Web A single mortgage point or just a point is equal to 1 of the amount you borrow.

Web This Mortgage Points Calculator allows you to use either positive or negative discount points. They cannot be used to pay any part of the down payment. Web 25 negative mortgage points Jumat 17 Maret 2023 Edit.

Web When a mortgage has negative points it means a lender has offered a cash rebate to the homebuyer to help offset the amount they have to pay at. Web How Negative Mortgage Points Work. Fractional points are commonly used by lenders to round off a rate to a standard.

When You Arent Planning on Owning the Home for Long The average duration of someone staying in a home is 105 years. Web Negative mortgage points are perfect for home buyers who have trouble coming up with the money to cover a down payment or any other fees due at closing. Web One thing to make sure is that the negative points can be used towards principal curtailment ie if the credits exceed closing costs it can be used to reduce the.

Contrary to positive points negative points can increase your interest rate but reduce closing costs. Web When To Use Negative Points 1. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

Which Is Better Points Or No Points On Your Mortgage

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Delta Optimist November 5 2020 By Delta Optimist Issuu

Mortgage Discount Points Calculator Mortgage Calculator

Change In Financing Rates Around Term Securities Lending Facility Auctions Download Table

Ex99 2xq42021investorpre

Investment Loan Rates Investment Property Home Loans Mozo

25 Cash Advance Apps Like Moneylion Say Goodbye To Payday Loans In 2023

105 How To Stay Grounded While Running An 8 Figure Real Estate Business Jonathan Yoo By Discover More

First Time Home Buyer Guide Nc And Sc Edition

Rhg Mortgages Page 2 Productreview Com Au

Reduce Home Loans Page 8 Productreview Com Au

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-02-cbf865c01dec4ce1b6061a92ed81cac8.jpg)

Employee Stock Options Esos A Complete Guide

An After Tax Analysis Of Negative Mortgage Points Monfort College

Mortgage Points Calculator Nerdwallet

Mortgage Points Calculator Calculate Emi With Without Points

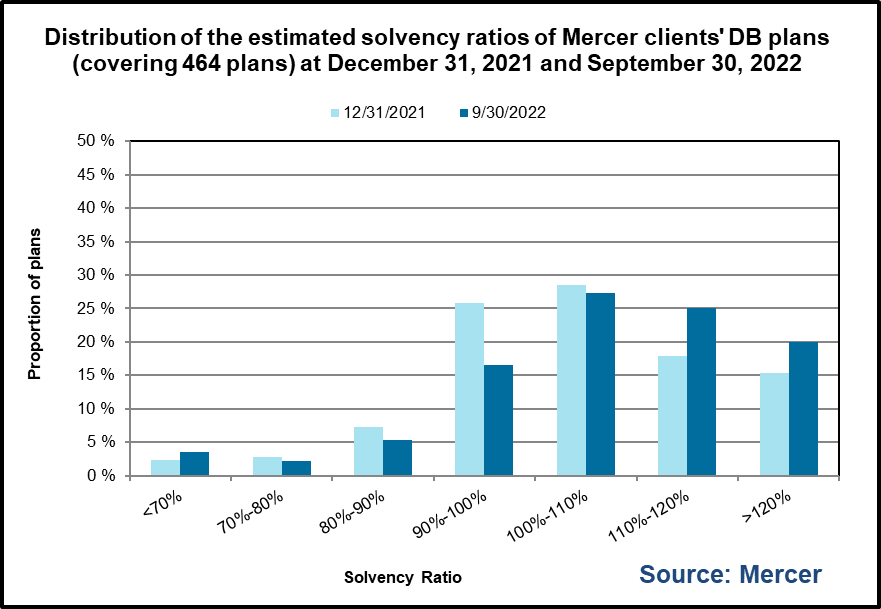

Defined Benefit Pensions Lagged In Third Quarter But Continue To Withstand Volatile Markets And Historic Inflation Mercer Financial Independence Hub